Online Tax Rebates E-refund

Realizing Automation in Documentation, Taxation, and Foreign Exchange Settlement for Export Enterprises, Combined with an Integrated Transaction Service Platform, to Achieve Full-process Visibility and Automation in Declaration for Foreign Trade Export Orders, Logistics, Taxation, and Foreign Exchange, Thereby Comprehensively Improving the Work Efficiency of Foreign Trade Enterprises, Shortening the Tax Rebate Cycle, Accelerating Tax Refund, Reducing and Preventing Possible Exchange Rate Risks, and Increasing Foreign Exchange Earnings.

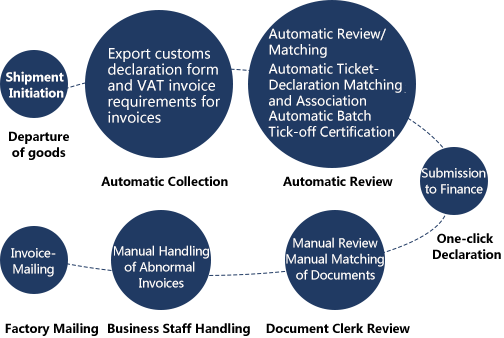

Export Tax Rebate Product Process

![]()

Automatic Association with Customs Declarations

Upon customs clearance and shipment of goods, Export Goods Customs Declaration (Confirmed) data can be obtained, and all paper customs declarations can be directly printed through the system with 100% accurate data, which can be used for export tax rebates.

![]()

Automatic Generation of VAT Invoice Requests

1.After obtaining customs declaration data, a request letter for VAT invoices from manufacturers is automatically generated to the finance department to confirm the invoice tax amount.

2.Manufacturers promptly obtain invoicing requirements and data through the input invoice sub-platform.

3.Once the manufacturer issues the invoice, the platform retrieves the data.

![]()

Pre-audit of automatic order allocation, invoice-order matching, and review

Automatically compare key element data between VAT invoices and export customs declarations based on invoicing requirements.

![]()

Automatic submission of certification application for tax rebate declaration and refund (or exemption) of taxes

1、The input invoice subsystem batch-submits the special invoices for certification (tick-box certification) after they have been reviewed and approved for order allocation.

2、Automatically generate and submit pre-declaration data for foreign trade tax exemption and rebate based on the allocated order data.

Offline Original Operation Process

Total time: 70 to 80 days

E-Refund Operation Process

One-click Declaration for Tax Rebate (Exemption)

For Class I export enterprises: From the shipment of goods to the receipt of the tax refund notice and the corresponding tax refund.

it takes 70 to 80 days, with long waiting times for enterprises.

it takes 70 to 80 days, with long waiting times for enterprises.

京公网安备11010502044601号

京公网安备11010502044601号