Customs Clearance and LogisticsSAASServices

SAAS SERVICE FOR

CUSTOMS CLEARANCE LOGISTICS

Intelligent Document Preparation

Advantage One: Automation

Combining big data cloud processing to perform logical checks on standardized declarations across the entire customs region for documents, ensuring the accuracy of declaration data and achieving a zero error rate for customs clearance declarations. Reducing workload and business processing; business processing costs are reduced by 2/3, statistical analysis at zero cost, and zero error rate for secondary data processing.

Rapid Connection

Advantage Two: Rapidity

● One-time connection for nationwide collaboration, one-click upload to all national single window customs services; all business processing data can be uploaded to the official system with one click, eliminating the need for secondary data entry.

● Business document walkthrough testing meets the full-process walkthrough testing needs for enterprise materials, workshops, semi-finished products, and finished product business data.

Compliance with Customs Policies

Advantage Three: Risk Control

The system can be continuously updated for free according to changes in customs policies. It realizes effective data flow integration between corporate finance, factory logistics, and customs affairs.

Trade Compliance

Advantage Four: Compliance

The system is equipped with powerful customs declaration specifications, declaration elements, and categorization precedent big data. Products can be pre-categorized in just three steps through the platform.

Trade Compliance Error Correction

The system automatically simulates customs document review principles to conduct intelligent reviews of the prepared documents for declarations, avoiding risks in enterprise trade management.

Logistics and Warehousing Management System

9Special Features

-

Unrestricted by Geography/Network

The system is unrestricted by geography and network, allowing simultaneous use in multiple locations both domestically and internationally.

-

Fine-Grained Authorization

It allows for assigning different system permissions to different system accounts. Even on the same interface, different accounts can be granted different usage permissions.

-

Information Entry Verification Mechanism

For the entry of standardized information, the system has a verification mechanism. When incorrect information is entered, a pop-up window will appear with a prompt.

-

Retrieve Previous Data

When information that has already been entered into the system is entered again, the system will automatically match the previously entered data for quick operation.

-

Detailed Bill and Summary Bill Management

It can provide a single detailed bill for each shipment for the same customer, as well as a summary of all bills under their name.

-

My Center

In "My Center," there is an interface for "Unsettled Freight and Tax Management." Each responsible person can go to this page to query the settlement status of their fees.

-

Bank Statements

It allows for assigning different system permissions to different system accounts. Even on the same interface, different accounts can be granted different usage permissions.

-

Tax Control Export and Import

The invoice management interface can interface with the tax system. By clicking "Tax Control Export," invoicing information can be directly imported into the tax control system. After invoicing is completed, clicking "Tax Control Import" can directly return invoice/invoice number information back into the system.

-

File Sharing

Files shared internally or externally within the company can be stored here and can be sent to the bound email address with one click at any time.

Freight Forwarder System Workflow Diagram

Administrative Department

Establish Customer Information

When there are new customers, customer files need to be established in the system, including basic customer information, customer customs inspection information, financial information, etc.

Business Department

Accept and Execute Customer Entrustments

Each entrustment needs to have a file (CASE) established in the system, recording detailed entrustment information, including transportation information, warehousing information, customs inspection information, insurance information, etc.

Business Department

Enter Fees

Based on the actual business-generated receivables and payables, each customer service department and salesperson will enter their respective fees in the CASE.

Business Department

Complete and Review Entrustments

When an entrustment is completed and the fees are entered and confirmed, customer service personnel will give a "completed" mark, followed by a review by the business leader.

Business Department

Fee Modification and Supplementary Review (if needed)

After the CASE is reviewed, the originally entered fees cannot be modified. If fees need to be adjusted at this time, customer service personnel need to add the fees on the CASE fee interface, followed by a supplementary review by the business leader.

Business Department

Invoice Review

For fees that need to be collected, the salesperson needs to confirm the invoicing type and apply for invoicing in the system invoice management interface.

Financial Department

Bank Detailed Account Import

Financial personnel will import yesterday's bank statement details into the "Bank Details" interface daily to facilitate querying arrivals and checking for any missed settlements.

Business Department

Receipt Application

Regarding information on funds that have been received, business personnel can complete the received application in the "My Center" - "Unsettled Freight and Tax" interface.

Business Department

Payment Application

Business personnel can apply for payment amounts in the system bill management interface or the "My Center" - "Unsettled Freight and Tax Management" interface, and manually fill out expenditure vouchers (including customer codes, payment amounts, etc.) to submit to the finance department.

Financial Department

Receipt/Payment Financial Review

Financial personnel will enter the approval management interface and review the completed receipt/payment applications, confirming them as correct and giving a "approved" mark.

Financial Department

Complete Payment

For payment entries that have completed financial review, the financial personnel will arrange for the payment to be completed.

Financial Department

Issue Invoice

The invoice management interface can interface with the tax system. By clicking "Tax Control Export," invoicing information can be directly imported into the tax control system. After invoicing is completed, the invoicing date/invoice number information can be automatically returned to the system by clicking "Tax Control Import."

Full tracking of trade delivery processes

real-time status feedback, and proactive alerts for abnormal situations.

1.Logistics Information Transparency

Information Feedback, Route Cost Optimization, Full-journey Safe Tracking of Goods

2.Business Process Transparency

Visualization of Business Process Networks

- Inquiry

- Quotation

- Booking

- Customs Clearance

- Expenses

- Order Management

3.Supply Chain Transparency

Supply Chain Collaboration, Industry Collaboration, Upgrades, and Optimized Layout

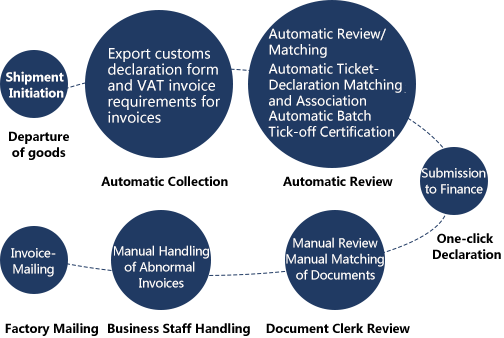

Online Tax Rebates E-refund

Realizing Automation in Documentation, Taxation, and Foreign Exchange Settlement for Export Enterprises, Combined with an Integrated Transaction Service Platform, to Achieve Full-process Visibility and Automation in Declaration for Foreign Trade Export Orders, Logistics, Taxation, and Foreign Exchange, Thereby Comprehensively Improving the Work Efficiency of Foreign Trade Enterprises, Shortening the Tax Rebate Cycle, Accelerating Tax Refund, Reducing and Preventing Possible Exchange Rate Risks, and Increasing Foreign Exchange Earnings.

Export Tax Rebate Product Process

![]()

Automatic Association with Customs Declarations

Upon customs clearance and shipment of goods, Export Goods Customs Declaration (Confirmed) data can be obtained, and all paper customs declarations can be directly printed through the system with 100% accurate data, which can be used for export tax rebates.

![]()

Automatic Generation of VAT Invoice Requests

1.After obtaining customs declaration data, a request letter for VAT invoices from manufacturers is automatically generated to the finance department to confirm the invoice tax amount.

2.Manufacturers promptly obtain invoicing requirements and data through the input invoice sub-platform.

3.Once the manufacturer issues the invoice, the platform retrieves the data.

![]()

Pre-audit of automatic order allocation, invoice-order matching, and review

Automatically compare key element data between VAT invoices and export customs declarations based on invoicing requirements.

![]()

Automatic submission of certification application for tax rebate declaration and refund (or exemption) of taxes

1、The input invoice subsystem batch-submits the special invoices for certification (tick-box certification) after they have been reviewed and approved for order allocation.

2、Automatically generate and submit pre-declaration data for foreign trade tax exemption and rebate based on the allocated order data.

Offline Original Operation Process

Total time: 70 to 80 days

E-Refund Operation Process

One-click Declaration for Tax Rebate (Exemption)

For Class I export enterprises: From the shipment of goods to the receipt of the tax refund notice and the corresponding tax refund.

it takes 70 to 80 days, with long waiting times for enterprises.

it takes 70 to 80 days, with long waiting times for enterprises.

One-stop Global Trade Facilitation

Delivery Platform

Understanding E-Neng tong About Us

Help & Support Contact Us Feedback & Suggestions Copyright Infringement Report

E-Neng tong Official Public Account Building an Ecological Platform for "Internet + Logistics Chain

京公网安备11010502044601号

Address: Chaoyang, Beijing, China

京公网安备11010502044601号

Address: Chaoyang, Beijing, China