Why is AEO Certification Necessary?

Necessity is the highest value of all systems. AEO certification, as a business card and reputation for excellent enterprises, has the following recognized necessities.

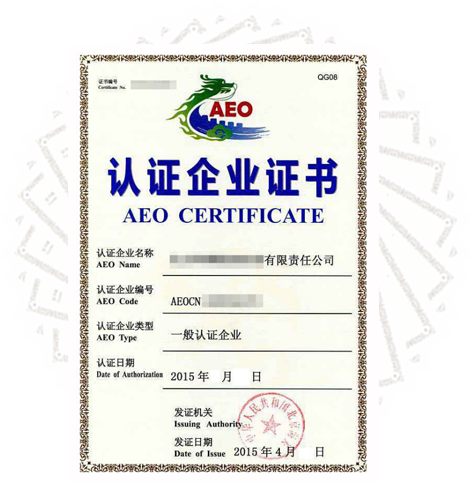

AEO Consultation

Certification

![]()

Conditions for Trade Transactions

Recently, the international community has increasingly paid attention to logistics security, making trade transaction conditions more complex. In addition to existing transaction condition fulfillment requirements, enterprises that have made AEO recognition a transaction condition are gradually increasing. Therefore, if an enterprise has not obtained AEO recognition, its trading partners and scope of trade activities will gradually shrink, or it may suffer unexpected losses. It can be said that in future international trade, if you are not an AEO enterprise, you will be excluded from the commercial game, equivalent to being forcibly removed from the playing field. Whoever obtains AEO first will have a future first.

![]()

Improving Export Competitiveness

Rapid customs clearance is the top concern for export enterprises. Customs clearance issues are difficult for private enterprises to control. Not only do enterprises have inadequate understanding of local regulations and systems, but also due to differences in tariff administration and logistics infrastructure environments among countries, there are limitations that private enterprises find difficult to resolve on their own. AEO certification can solve the above problems. AEO enterprises gain the trust of customs and international recognition, and can therefore alleviate trade barriers and improve export competitiveness through AEO.

![]()

Various Enterprise Benefits

AEO enterprises are recognized by the state as trustworthy enterprises, so they can apply for more rapid and simplified trade procedures when importing and exporting. When mutual recognition agreements are signed with other countries implementing AEO, AEO enterprises can also obtain benefits and concessions such as reduced inspection rates for rapid customs clearance in the signatory countries. In general, this can save lead times and various costs in international trade transactions.

![]()

Improving Enterprise Management Levels

AEO is a certification for excellent enterprises, with continuous improvement requirements in a series of processes and management systems. Through AEO, enterprises can optimize their internal management levels and change chaotic and disorganized management.

(New Standards) Comparison of Benefits Between General Credit Enterprises and Certified Enterprises (AEO)

| Serial Number | Preferential Terms | Terms and Conditions instructions | General Credit | General Certification | Advanced Certification |

|---|---|---|---|---|---|

| 1 | Customs Inspection Rate | Example of Customs Inspection Rate for Import and Export Clearance | 5% | 1.8% | 0.8% |

| 2 | Centralized Tax Payment | For imported goods taxed under general trade, customs clearance is conducted first, followed by centralized tax payment at the end of the month (no need to pay taxes individually before customs clearance and release) | Not Allowed | Allowed | Allowed |

| 3 | Trusted Release | Before customs has finalized the declaration (e.g., disputes over HS codes, customs valuation, inspection issues pending amendment), goods may be released based on a guarantee letter issued by the enterprise | Not Allowed | Allowed | Allowed |

| 4 | Customs Clearance Cost | 1)Cost savings on logistics due to reduced inspection rates 2)Financing cost savings for enterprises due to delayed tax payment under centralized tax payment |

Baseline/0% Savings | 3.5% Savings | 4.5% Savings |

| 5 | Customs Clearance Efficiency | Overall Customs Clearance Efficiency:

1) Impact of credit rating on the timeliness of customs order acceptance 2)Impact of reduced inspection rates on release efficiency3)Impact of centralized tax payment on customs release efficiency |

Baseline/0% Savings | accelerated by 18% | accelerated by 28% |

| 6 | AEO International Mutual Recognition | Recognition of AEO status by mutual recognition countries for suppliers, enjoying overseas customs clearance facilitation (reduced port inspection rates) | Not Allowed | Not Allowed | Allowed |

| 7 | Customs Audit Rate | Routine customs audits, with a specified percentage of enterprises being selected for inspection | High | Lower | Lowest |

| 8 | Processing Trade Deposit | For enterprises engaged in processing trade1) Exemption from deposit for leased factories 2)Exemption or reduced deposit for restricted items |

Payment for leased factories/establishment of account | No Payment for leased factories/establishment of account | No Payment/ no establishment of deposit account |

| 9 | E-Book Management | Qualification to apply for E-Book | Not Allowed | Allowed | Allowed |

| 10 | Specialized Service Window | Customs sets up specialized service windows to provide specific answers and coordination for enterprise issues | None | None | have |

Advantages of E-Neng tong AEO Consulting Services

Unlike the chaotic consulting service providers in the current AEO consulting market, such as customs clearance companies, software companies, accounting firms, and even customs affairs enterprises that only provide paper-based or copied consultation materials, E-Neng tong gathers experts from various fields and truly starts from the daily operation processes of clients. We do not pursue certification for its own sake, nor do we use templates or copy systems. Instead, we invest highly concentrated time and conduct intensive enterprise research, management evaluations, and process tracking to create customized AEO certification systems for enterprises in the shortest time. These systems have a fit rate of 90%-95% with enterprises' own management systems, quality and environmental management systems, and information security systems. They are easy to implement and understand.

Currently, E-Nengtong has a 100% success rate in assisting enterprises to pass AEO certification, with clients experiencing a smoother application process than ordinary enterprises. This saves enterprises the time cost of self-research, reduces the risk of failure, and improves project efficiency.

京公网安备11010502044601号

京公网安备11010502044601号